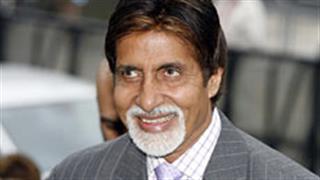

Court rejects appeal by Income Tax department against an order in favour of the actor

Bombay High Court recently dismissed an Income Tax department appeal against an order in favour of actor Amitabh Bachchan, holding that the plea did not involve ‘any substantial question of law'.

On October 13, 2002, Bachchan had filed his income tax return, declaring his earnings to be Rs 14.99 crore, for the assessment year 2002-2003. On March 31, 2002, he filed a revised return of income on the basis of

estimates by his insurance agents, where he claimed 30 per cent expenses amounting to Rs 6.31 crore, ultimately determining his income to be Rs 8.11 crore.

Before the evaluations for that assessment year could be completed, Bachchan sent a letter withdrawing the revised return, along with the 30 per cent ad hoc expenses from his total income. On March 29, 2005, the

Assessing Officer (AO) completed the assessment for the year 2002-2003, and determined Bachchan's income to be Rs 56.41 crore.

The I-T factor

On April 5, 2006, Bachchan received a notice from the Commissioner of Income Tax (Central – I) seeking to reopen the assessment of his income for 2002-2003, as the AO had reason to believe that some income had

escaped assessment.

Following the notice, Bachchan was assessed for a total income of Rs 20.05 crore, a figure arrived at after adding an amount of Rs 6.31 crore as unexplained expenses.

In Bachchan's petition, he maintained that he had never incurred those expenditures and simply claimed the deduction on advice that he was eligible to claim it.

Bachchan appealed to the Commissioner of Income Tax (Appeals), who set aside the order for reassessment, holding that the AO had wrongly assumed jurisdiction under Section 147 of the I-T Act.

The I-T

Commissioner (Central – I) appealed to the I-T Tribunal which held in a March 19, 2010 order that ‘no new material, which had come to the notice of the Assessing Officer so as to lead to a reasonable belief that

income assessable to tax has escaped assessment... there was no fresh tangible material for the AO to initiate reassessment proceeding.'

A division bench comprising Justices SJ Vazifdar and MS

Sanklecha, while dismissing the appeal on July 5, observed, "Both the Commissioner of Income Tax (Appeals) and the Tribunal have correctly come to the conclusion that there was no fresh tangible material before the

Assessing Officer to reach a reasonable belief that the income liable to tax has escaped assessment... It is a settled position of law that review under the garb of reassessment is not permissible."

The

court contended that since Bachchan had withdrawn the revised return before completion of assessment, there was technically no fresh material before the AO to be reopening the case.

HC relief for Big B's tax woes

Tuesday, July 24, 2012 12:18 IST